Corsair CX-9070014-WW iCUE LINK GPU RGB Adapter integrates your non-iCUE LINK XG7 or XG5 GPU Water Block with the iCUE LINK ecosystem for a streamlined setup with less cable mess. CX-9070014-WW

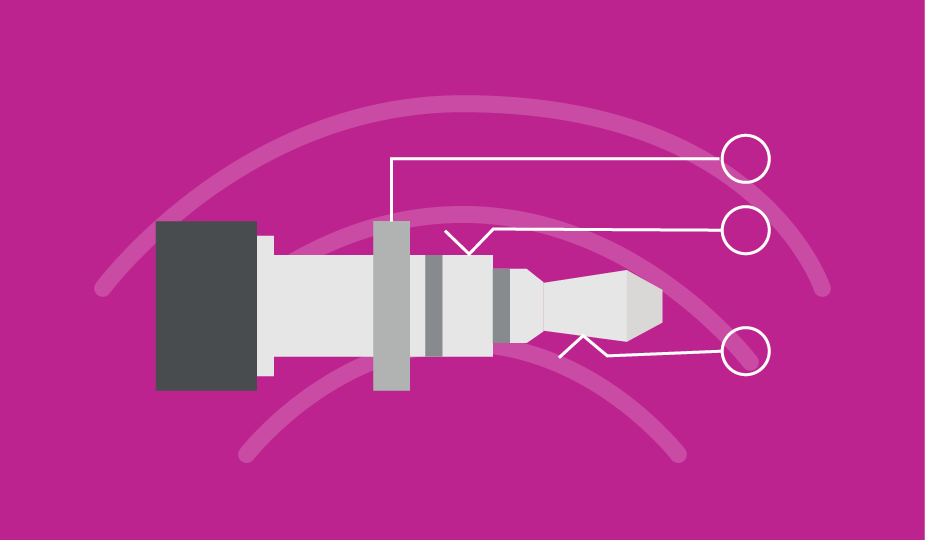

StarTech.com 4 Position Microphone and Headphone Splitter 3.5 mm 4 Pin / 4 Pole Mic and Audio Combo Splitter Cable (MUYHSMFFADW) - Kuulokkeiden jakaja - mini-phone stereo 3.5 mm naaras to 4-pole

Ugreen AUX splitter cable 3.5 mm mini jack (female) - 2x 3.5 mm mini jack (male - microphone and headphones) black (AV140 20899) - B2B wholesaler.hurtel.com

StarTech.com 4 Position Microphone and Headphone Splitter 3.5 mm 4 Pin / 4 Pole Mic and Audio Combo Splitter Cable (MUYHSMFFADW) - Kuulokkeiden jakaja - mini-phone stereo 3.5 mm naaras to 4-pole

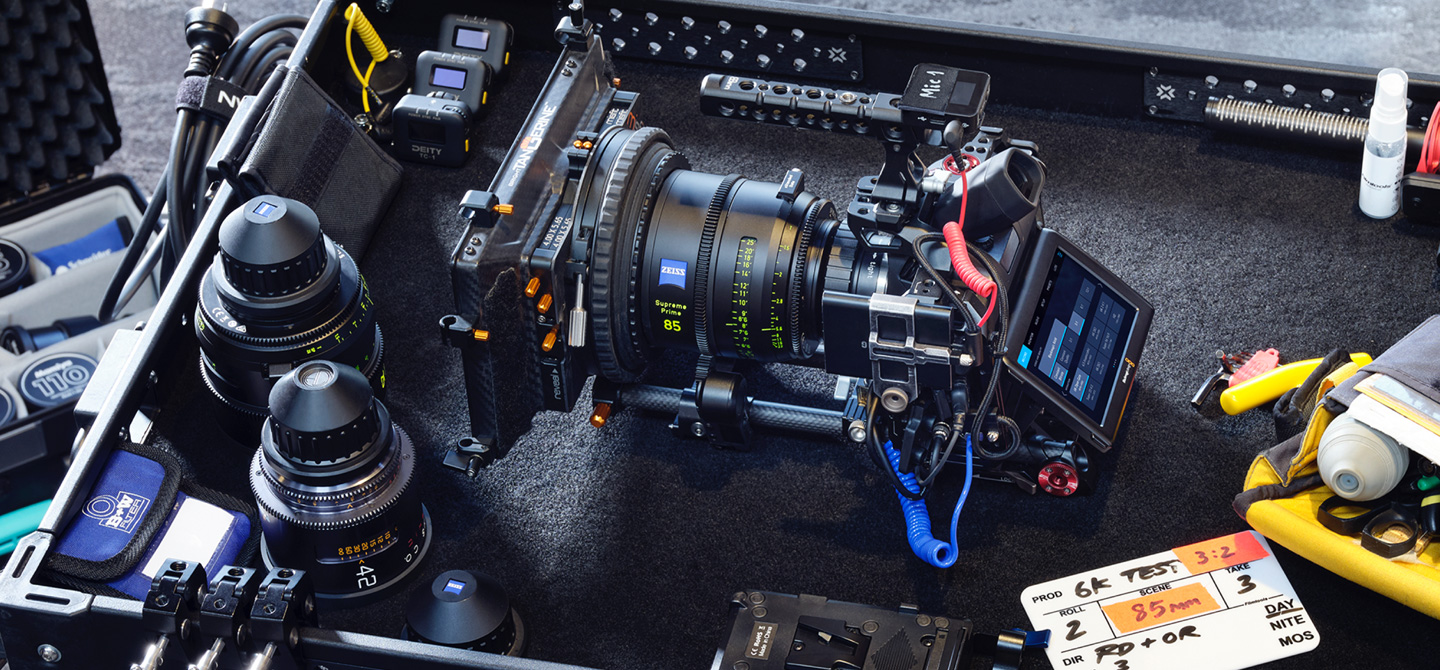

Sony Unveils Three Wireless Microphones with Exceptional Sound Quality, Light Weight and Unparalleled Portability | Sony | Alpha Universe

Amazon.com: Monster Gen1 Essentials Mini-to-Mini Audio Interconnect Cable - 3.5mm Stereo Male-to-Male Car AUX Cord with Duraflex Jacket, 5FT : Electronics

1.5 FT - Mogami 3082 / Neutrik - Combo Amp Speaker Cable - Right Angle Plug To .205" Spade Connector 1 SPK | Reverb Finland

Sound Blaster X4 - Hi-res 7.1 External USB DAC and Amp Sound Card with Super X-Fi® and SmartComms Kit for PC and Mac - Creative Labs (United States)

Amazon.com: Xiaoyztan 20 Pcs 3.5mm/0.137" Panel Mount Female Mono Socket Headphone Audio Jack PCB Connector : Electronics

Fractal Design Ridge Mini-ITX Slim Small Form Factor Console PC Case with PCIe 3.0 Riser - White FD-C-RID1N-02

Amazon.com: OREI European Plug Adapter Set Works in Albania, Austria, Belgium, Denmark, Finland, Greece, Hungary, Iceland, Netherlands, Norway, Poland, Portugal, Romania, Spain, Sweden, Turkey : Tools & Home Improvement